Nebraska Estimated Tax Payments 2024. This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you. Instructions for paying your individual income tax balance due;

Calculations are estimates based on tax rates as of jan. The 2024 tax rates and thresholds for both the nebraska state tax tables and federal tax tables are comprehensively integrated into the nebraska tax calculator for 2024.

Estimate Your Tax Liability Based On Your Income, Location And Other.

Form 1040xn, 2023 amended nebraska individual income tax return.

Instructions For Paying Your Individual Income Tax Balance Due;

To compute your estimated tax, complete the nebraska individual estimated income tax worksheet (on page 4).

Central Time On The Date The Payment Is Due To Be Considered Timely.

Images References :

Source: printableformsfree.com

Source: printableformsfree.com

Nebraska Estimated Tax Form 2023 Printable Forms Free Online, 1040n, nebraska individual income tax return, last date for farmers and ranchers to file 2023 income tax return in lieu of making payments of estimated nebraska income tax. Updated on apr 24 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Provides tax credits related to child care, for families and providers. Additionally, if you submit your 2023 federal income tax return by jan.

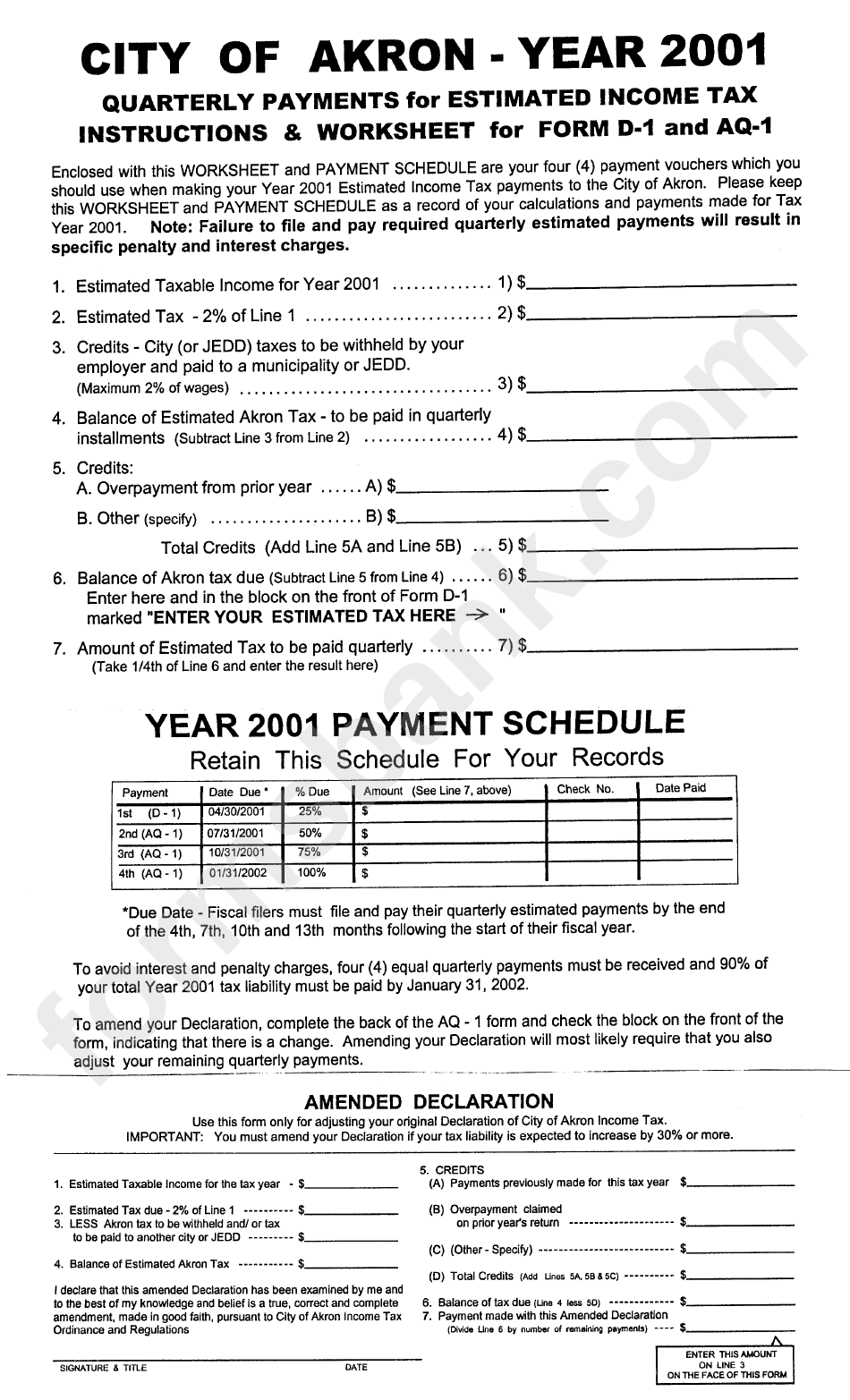

Source: www.formsbank.com

Source: www.formsbank.com

Quarterly Payments For Estimated Tax Form printable pdf download, However, the entity will need to make estimated tax payments (even if it is. 001.01 every resident and nonresident individual shall make payments of nebraska individual estimated income tax if his or her estimated nebraska individual income tax.

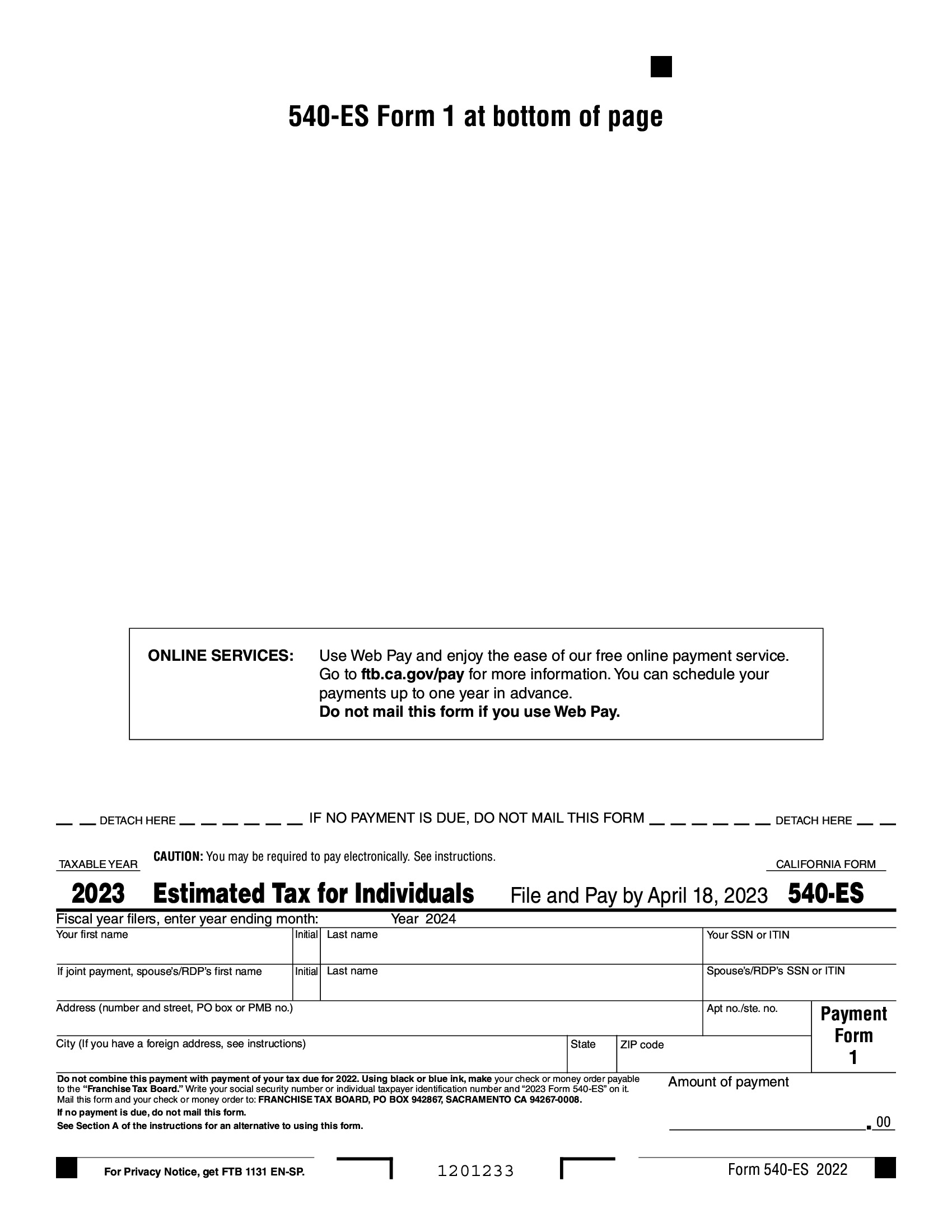

Source: blanker.org

Source: blanker.org

FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2023, Central time on the date the payment is due to be considered timely. Delivers full tax exemption for social security benefits a year early in 2024.

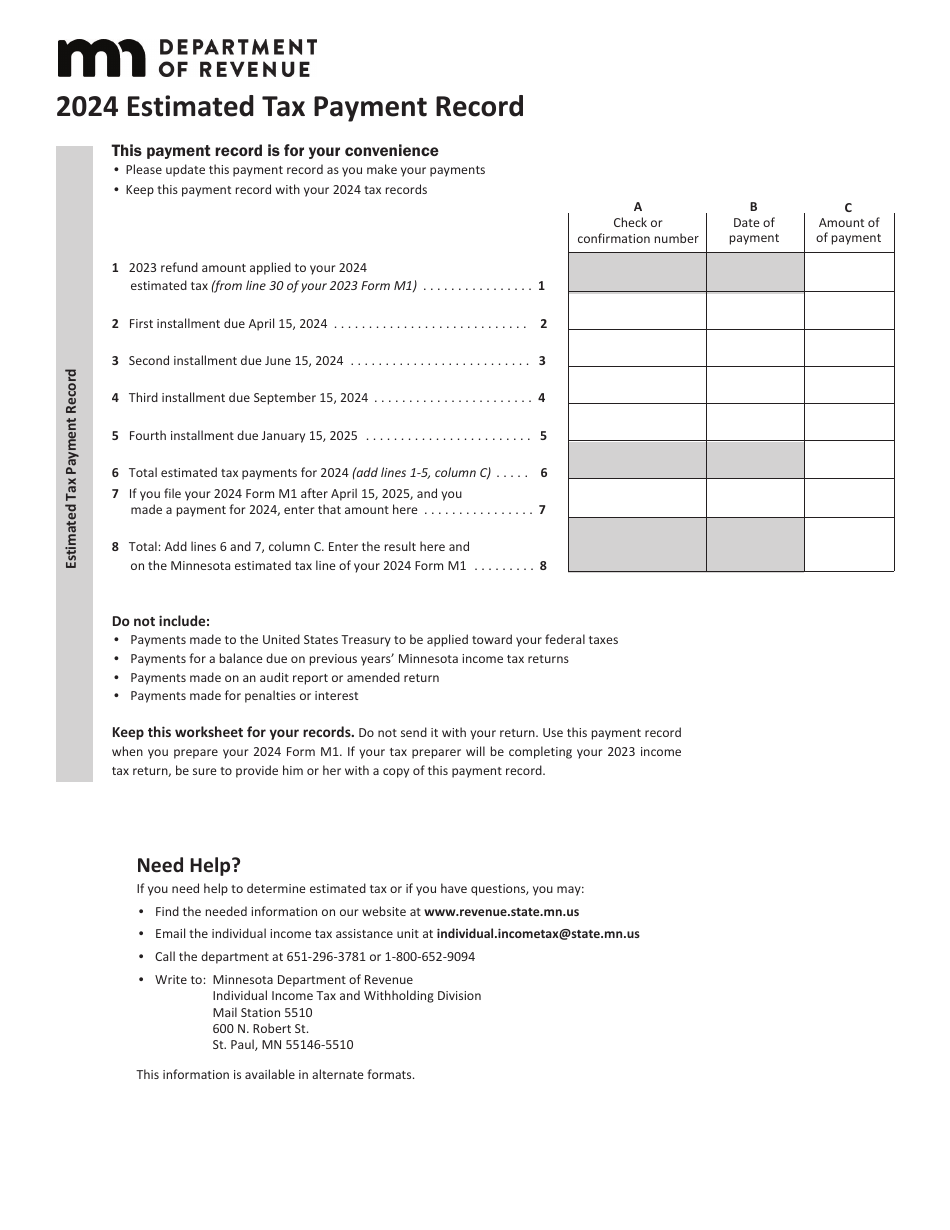

Source: www.templateroller.com

Source: www.templateroller.com

2024 Minnesota Estimated Tax Payment Record Download Fillable PDF, However, the entity will need to make estimated tax payments (even if it is. Calculate your nebraska state income taxes.

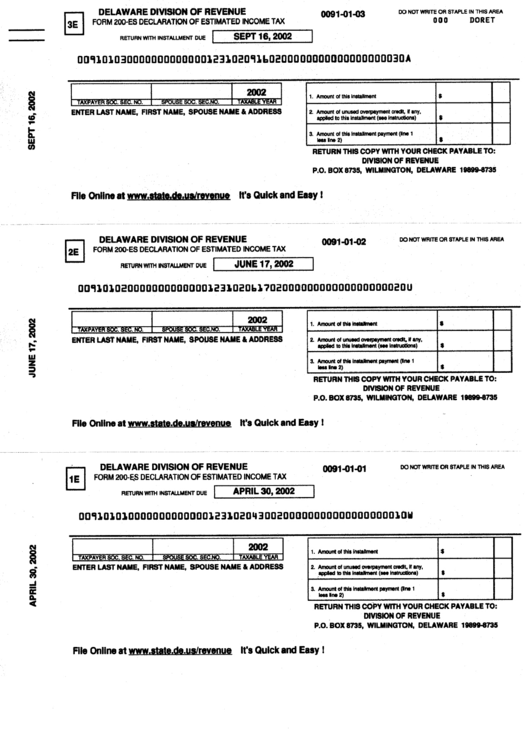

Source: www.formsbank.com

Source: www.formsbank.com

Form 200Es Declaration Of Estimated Tax Delaware Division, However, the entity will need to make estimated tax payments (even if it is. Department of the treasury internal revenue service.

Source: www.dochub.com

Source: www.dochub.com

1040n Fill out & sign online DocHub, Under lb 754, the top individual income tax rate is lowered from 6.84% to 5.84% for tax year 2024, 5.2% for 2025, 4.55% for 2026 and 3.99% for 2027 and subsequent years. 001.01 every resident and nonresident individual shall make payments of nebraska individual estimated income tax if his or her estimated nebraska individual income tax.

Source: support.joinheard.com

Source: support.joinheard.com

Paying State Tax in Nebraska Heard, However, the entity will need to make estimated tax payments (even if it is. Estimate your tax liability based on your income, location and other.

Source: tax.thomsonreuters.com

Source: tax.thomsonreuters.com

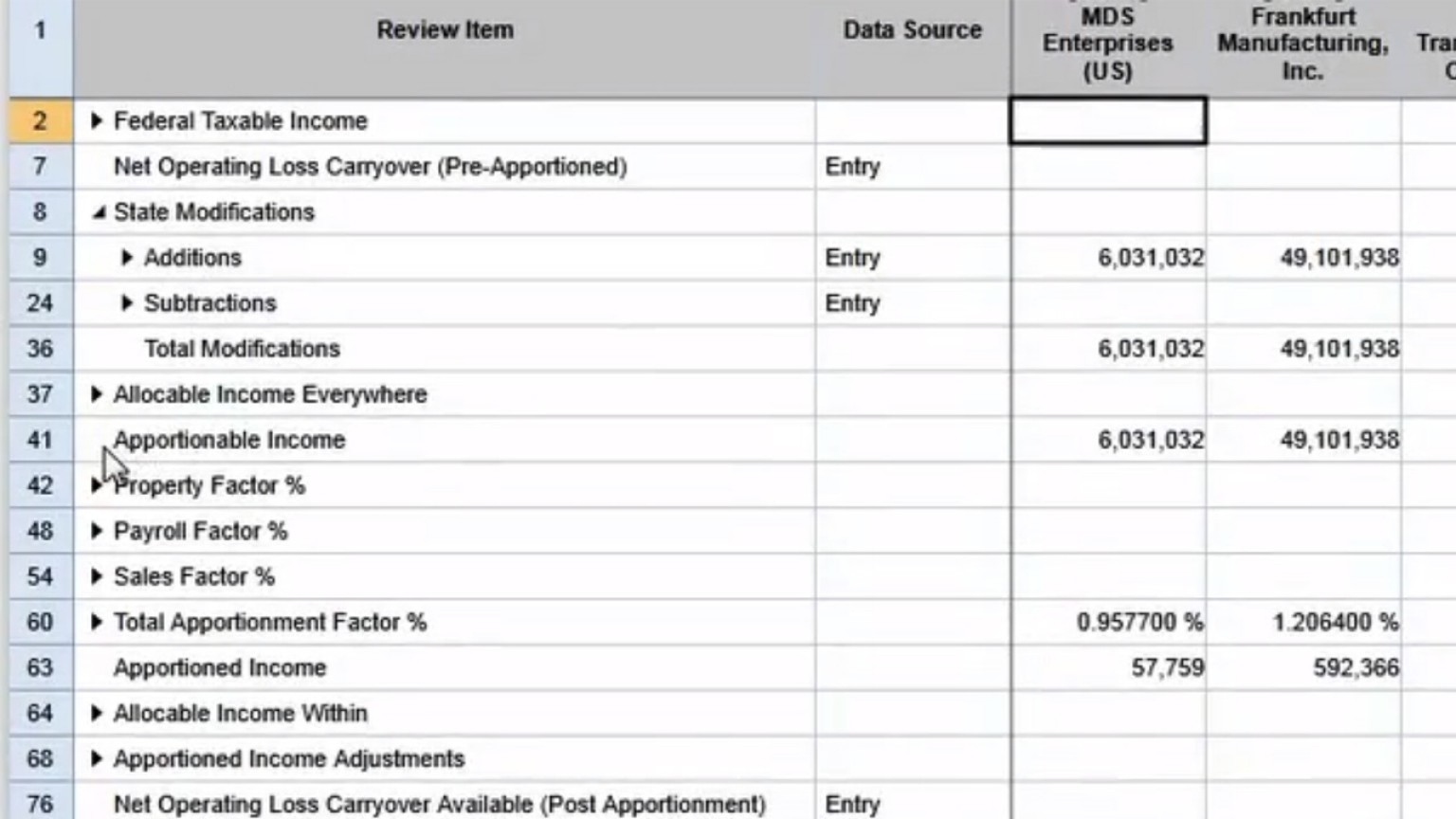

Estimated tax payments software by Thomson Reuters ONESOURCE Thomson, Form 1040xn, 2023 amended nebraska individual income tax return. Central time on the date the payment is due to be considered timely.

Source: sammiajocie.blogspot.com

Source: sammiajocie.blogspot.com

Estimated federal tax payments SammiaJocie, Form nol, nebraska net operating loss worksheet tax year 2023. C corporation estimated tax requirements will apply for electing ptes, but no payments will be required for tax years beginning prior to january 1, 2024.

2023 And Data From The Tax.

Estimate your tax liability based on your income, location and other.

Provides Tax Credits Related To Child Care, For Families And Providers.

Under lb 754, the top individual income tax rate is lowered from 6.84% to 5.84% for tax year 2024, 5.2% for 2025, 4.55% for 2026 and 3.99% for 2027 and subsequent years.